4 Eye-Opening Reasons SMBs Should Offer Vision Care Coverage

Quick look: Over 30% of U.S. adults lack vision coverage, even though 94% of employees see it as important. Offering affordable vision insurance improves wellness, reduces healthcare costs, promotes equity, and helps small and midsized businesses (SMBs) attract and retain top talent. Here’s how vision care can benefit both your clients and the communities they serve.

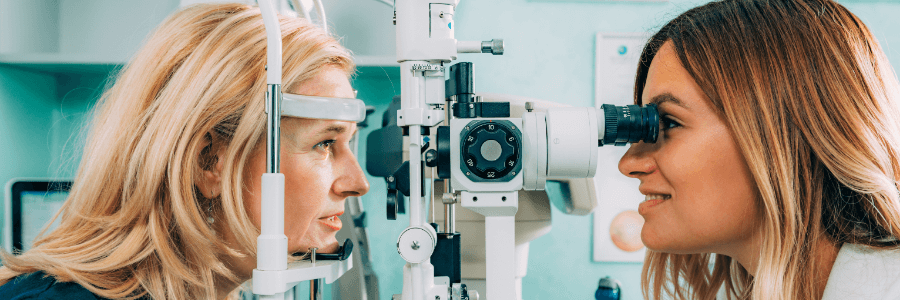

When small and midsized businesses (SMBs) think about employee benefits, health and dental insurance typically top the list. Yet vision coverage can significantly impact employee wellness, productivity, and retention.

The need is clear: while 82% of U.S. adults require some sort of vision correction, over 30% aren’t enrolled in vision insurance.

On World Sight Day, it’s the perfect time to explore how brokers can help bridge that gap while enabling SMB clients to lower costs and attract and retain talent.

A look at vision care

While vision care may seem straightforward, understanding what it covers and what might be excluded is key.

To start, it’s helpful to distinguish between two providers:

- Optometrist (OD): An OD handles fundamental eye care. They examine, diagnose, and treat eyes, assist patients who require contacts or glasses, and act as the first stop in treating uncomplicated eye conditions.

- Ophthalmologist (MD): Specializing in more complex conditions, an MD is a medical doctor who manages advanced eye conditions. MDs perform operations like cataract and glaucoma surgery and treat complex eye conditions.

Vision insurance plans typically cover an annual visit with an OD, the first line of defense to discover potential signs of underlying eye conditions. Health insurance plans usually don’t cover preventive vision care, making supplemental or standalone vision plans a necessity. Without vision coverage, people must either pay out of pocket or avoid receiving care altogether, a potentially costly and dangerous action.

Eye surgery or specialty care from an MD typically isn’t covered by vision care but by health insurance. Ideally, the two coverages combine to provide patients with a comprehensive solution for all eye health needs.

Who has vision care and who doesn’t?

While The Vision Council found that 31% of U.S. adults don’t have vision coverage, that doesn’t mean they don’t recognize its value. In fact, the opposite appears to be true: a Harris poll revealed that 94% of employees believe vision benefits are valuable. This discrepancy creates an opportunity for brokers to offer a highly sought-after benefit to those who want it most.

A blurry understanding of benefits

The same Harris research also discovered that 43% of employed adults with vision benefits have some difficulty understanding what’s covered, and nearly 60% wish their employer provided more helpful information. Additionally, 28% say the main reason they don’t always use benefits to cover vision care costs is confusion about what is and isn’t covered.

Brokers can help educate their clients’ staff by aligning them with a professional employer organization (PEO) that provides ongoing benefit communications, guidance during onboarding and open enrollment, and employee-level customer support to quickly answer questions.

The advantages of vision care are clear

Vision coverage offers more than just clear sight, it delivers wide-ranging benefits for individuals, employers, and society:

1. Enhances quality of life

If you’ve ever had to squint through blurry vision, you know how frustrating it can be. Vision insurance helps people avoid this by enabling affordable access to ODs.

Poor eye health doesn’t just cause frustration. Dry eyes, eye strain, and other serious eye conditions contribute to headaches, itching, back and neck soreness, and light sensitivity.

The good news is that brokers can alleviate these challenges by offering a competitively priced solution to their SMB clients.

2. Reduces healthcare costs

Preventive eye exams can uncover chronic conditions like diabetes, which cost trillions of dollars annually.

For example, diagnosed diabetes costs the country over $400 billion per year, and the Centers for Disease Control and Prevention (CDC) estimates 8.7 million Americans have undiagnosed diabetes.

The savings also extend to employers. Vision impairment costs the global economy $411 billion in lost productivity annually, making vision insurance a low-cost benefit with strong return on investment (ROI) potential for clients.

3. Levels the playing field

Including vision benefits in client offerings can play an important role in advancing equity.

Minority populations experience worse vision outcomes and less disease monitoring, and are at higher risk of glaucoma-related vision loss. Additionally, the CDC reports that:

- People with lower incomes are less likely to access preventive eye exams or be able to afford eyeglasses and are more likely to experience vision loss due to diabetic retinopathy.

- Those without a high school education are less likely to have visited an eye doctor in the last year compared to those with higher levels of education.

- People living with vision impairment or blindness are more likely to be uninsured and have more problems accessing care due to cost, insurance coverage, transportation, and providers refusing service.

Brokers promote equity in care by including affordable, high-quality vision plans in their benefit offerings.

4. Helps attract and retain top talent

Vision benefits appeal to today’s multigenerational workforce, from older employees requiring screenings for age-related eye diseases to families with children needing corrective lenses. This makes vision coverage a powerful tool for recruitment and retention.

PEO: Better benefits, better health, better business results

Vision care has advantages for everyone, from employees avoiding workplace headaches to businesses improving competitiveness and promoting equity.

By working with a PEO like ExtensisHR, brokers can give clients access to cost-effective, high-quality vision plans along with other Fortune 500-level benefits, such as:

- Comprehensive health insurance, including dental coverage, options for health savings accounts (HSAs) and flexible savings accounts (FSAs), and access to healthcare advocacy services to answer employees’ questions, provide cost estimates, find providers, etc.

- 401(k) retirement plans

- Student loan repayment programs

- Family-forming support

- Pet insurance

ExtensisHR also takes the complexity out of benefits administration. Our team manages enrollment, payroll deductions, and compliance, while our Employee Solution Center serves as an expert resource for employees by explaining plan terms and differences, helping navigate qualifying life events, and more.

A competitive benefits package helps employees stay healthy, keeps clients focused on success, and grows your book of business. Connect with ExtensisHR today to see how our PEO solution creates wins for brokers and their clients alike.