Employee Benefits: The Complete Guide for Businesses

Comprehensive employee benefits packages are essential for organizations to attract and retain top talent, and they are especially critical for small businesses to compete with larger competitors.

This thorough guide explores the many types of employee benefits, the value a robust benefits package provides both organizations and their staff, how SMBs can offer better employee benefits, cost considerations, and more.

What are employee benefits?

Employee benefits are non-wage compensations provided to employees in addition to their regular pay, which can include health insurance, retirement plans, and paid time off. These benefits help organizations attract and retain top talent by supporting employees’ overall well-being and promoting a healthy work-life balance.

Why is important to offer employee benefits?

Offering comprehensive employee benefits is crucial for businesses aiming to attract top talent—including millennials and Generation Z—boost retention, enhance employee engagement and satisfaction, strengthen company culture and branding, meet diverse workforce needs, and ensure legal compliance.

- Talent acquisition and retention

- Help attract top talent

- Boost employee retention—approximately two-thirds of workers say their benefits make them at least somewhat more likely to remain at their company

- Keeps businesses competitive

- Employee engagement and satisfaction

- Increases employee engagement and morale; 72% of employees say that the more benefits they receive, the happier they are at their jobs

- Improves employees’ quality of life, including their physical, mental, and financial wellness, and enables them to prepare for their future

- Company culture and branding

- Strengthen company culture and workers’ sense of belonging

- Enhances the employer’s brand

- Workforce needs and diversity

- Satisfy the needs of today’s diverse, dispersed, and multigenerational workforce

- Contributes to diversity, equity, and inclusion (DEI)

- Legal and compliance

- Maintains legal compliance (in some regions, offering certain benefits is a legal requirement)

- Mitigates the risk of legal disputes and penalties related to employee rights and benefits

Types of employee benefits

Many types of employee benefits exist, and are categorized as federally required, ancillary, or voluntary. Federally required employee benefits include things like health insurance and unemployment insurance, ancillary benefits are supplementary to primary benefits like health insurance or retirement plans, and voluntary benefits are optional plans that employees can choose to enroll in or purchase on top of their core benefits package.

Federally required employee benefits

Federally required employee benefits are legally mandated and include health insurance, workers’ compensation, Social Security and Medicare, unemployment insurance, and unpaid leave through the Family and Medical Leave Act (FMLA).

Health insurance

Several types of medical insurance plans exist, including:

Under the Affordable Care Act, employers with 50 or more full-time employees or full-time equivalent employees must provide medical insurance coverage to at least 95% of their full-time workers and their dependent children or incur federal penalties.

- Exclusive Provider Organization (EPO): Only covers services if you use doctors, specialists, or hospitals in the plan’s network (except in the case of an emergency).

- Point of Service (POS): You pay less if you use in-network providers, and a referral from a primary care doctor is required to see a specialist.

- Preferred Provider Organization (PPO): You pay less when you use in-network providers and can use out-of-network providers for an additional cost without a referral.

- Health Maintenance Organization (HMO): Typically limits coverage to providers who work for or contract with the HMO and usually doesn’t cover out-of-network care except in emergencies. HMOs may require patients to live or work in their service area to be eligible for coverage.

- High-deductible health plan (HDHP): Features lower monthly premiums and a higher deductible than traditional insurance plans and requires patients to pay more expenses before the insurance company begins to pay its share. HDHPs can be paired with a health savings account (HSA), which is triple-tax-advantaged and can be used to pay for certain medical expenses.

Continuation of Health Coverage (COBRA)

According to the U.S. Department of Labor, “the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102% of the cost to the plan.”

Typically, COBRA requires that employer-sponsored group health plans with 20 or more employees during the prior year offer workers and their families the opportunity for a temporary extension of coverage in certain situations where coverage under the plan would otherwise cease. COBRA also outlines how workers and their family members may elect this continued coverage and requires employers and health plans to provide notice.

Workers’ compensation

Workers’ compensation insurance protects employers and employees in the event of a workplace accident or illness by providing the injured or ill with:

- Wage replacement benefits

- Medical treatment

- Vocational rehabilitation

- And more

Workers’ compensation insurance mandates vary by state. At the time this page was written, 49 out of the 50 states required employers to carry worker’s compensation coverage.

Unemployment insurance

Unemployment insurance aids workers who have lost their jobs and exists on a federal and state level. Employers must pay into both federal and state unemployment programs, and in some states, employees must also contribute.

The Family and Medical Leave Act (FMLA)

FMLA enables eligible employees of covered employers to take job-protected unpaid leave for specific family and medical reasons. Covered employers include all public employers and private-sector organizations with 50 or more employees.

Eligible workers are entitled to:

- 12 weeks of leave in a 12-month period for:

- The birth of a child or the placement with the employee of a child for adoption or foster care.

- The care of an employee’s spouse, child, or parent with a serious health condition.

- A serious health condition that prevents the employee from performing their job’s essential functions.

- A qualifying exigency due to the employee’s spouse, child, or parent being a covered military member on “covered activity duty.”

- 26 weeks of leave in a 12-month period for the care of a spouse, child, parent, or next of kin who is a covered servicemember experiencing a serious injury or illness.

Note that some states and local jurisdictions have their own paid/unpaid family leave and/or paid/unpaid sick and safe leave.

Social Security and Medicare

Both employers and employees must contribute to these funds. Social Security provides income for retired workers, dependents, and disabled workers and their families, while Medicare pays for the medical care of retirees and people with long-term disabilities.

Ancillary benefits

Ancillary benefits are typically supplementary benefits provided by an employer alongside federally required benefits. Employees often have the option to enroll in ancillary benefits but may not be required to do so. Ancillary benefits are usually funded at least in part by the employer, although employees may also contribute through payroll deductions.

Common ancillary benefits include dental, vision, and life insurance, retirement savings plans, paid time off, student loan repayment programs, tuition/professional development reimbursement, and Employee Assistance Programs (EAP).

Dental insurance

Dental insurance typically covers preventative care, including teeth cleanings and X-rays, basic procedures (i.e., fillings), and major procedures (i.e., crowns). Plans may also cover orthodontics.

Vision insurance

Vision insurance often includes a fixed set of benefits, including routine eye exams and tests and discounts on glasses and contacts.

Telehealth and health advocacy

While not required, telehealth and health advocacy employee benefits can be valuable to workers. Telehealth enables patients to see their doctors without going to their physical office, while health advocacy offers access to expert assistants who can answer benefits questions, deliver cost estimates, aid with billing and claims issues, find providers, and more.

Life insurance

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a designated sum of money to a designated beneficiary in the event of the insured person’s death.

Retirement savings plans

Several types of retirement plans exist, including but not limited to:

- 401(k): The most common type of retirement plan offered by employers, which allows both employer contributions and employee salary deferrals.

- 403(b): Similar to a 401(k), but available only to workers at public schools and select non-profit organizations

- 457: Also like a 401(k) but for state and local government employees

- Pension: A defined benefit plan that provides a certain monthly income to retired workers, typically based on their salary history and years of service

Note: The SECURE 2.0 Act included new rules regarding employer-sponsored retirement plans. Please refer to current legislation for further details.

Paid time off (PTO)

In addition to the mandated FMLA, employers may enact various types of leave policies:

- Vacation time off: Paid time off typically used for rest and relaxation.

- Sick/personal time off: Can be used in the event of the following:

- The diagnosis, care, or treatment of, or recovery from, an employee’s or a family member’s mental or physical injury or other adverse health condition.

- Preventive medical care for the employee or their family member.

- Closure of the employee’s workplace or their child’s school or childcare provider due to a public health emergency.

- The employee attends a school-related conference or meeting regarding their child’s education or health conditions/disability.

- Miscellaneous reasons, including pet illness/loss, personal holidays, physical/mental wellness days, and personal time.

- And more

- Life event time off: Paid time off to attend to life events like engagements, marriages, divorces, the birth of a grandchild, selling or purchasing a home, moving into a new apartment, vehicle accidents, storm cleanups, loss of power, flight cancellations, and more.

- Floating holidays: Allows employees to take off when they have something important to celebrate without closing the entire business, which can contribute to a holiday policy’s inclusiveness.

- School activity time off: Paid time off for working parents to participate in their child’s school or childcare activities.

- Bereavement leave: Paid time off to grieve the loss of a loved one.

- Voting time off: Paid time off to participate in local, state, or federal elections.

- Volunteering time off (VTO): Paid time off to volunteer at an approved non-profit organization.

- Maternity/paternity leave: Available to eligible employees following the birth of a child.

- Bonding leave: Available to eligible staff members to bond with a child after their birth, adoption, or fostering placement.

Student loan repayment programs

Employers may contribute a certain amount to employees’ student loans per month and/or offer access to student loan management tools like payoff projectors, refinancing resources, and more.

Tuition/professional development reimbursement

Organizations can develop a policy in which they reimburse a select amount per year for continuing education through an accredited program that offers growth related to a worker’s current or desired role.

Employee Assistance Program (EAP)

An EAP is a program that provides employees with free access to professional support for a variety of issues, including mental and emotional well-being; family, marital, and other relationship issues; life improvement/goal setting; substance abuse; work- or family-related stress; financial and legal concerns; and more.

Voluntary benefits

Voluntary benefits are optional offerings that employees can choose to purchase through their employer to supplement their required and ancillary benefits. Unlike ancillary benefits, voluntary benefits are usually entirely funded by the employees who opt to enroll in them. Employers may negotiate group rates or make these benefits available through payroll deduction, but the cost is primarily paid by the employees who elect to participate.

Examples of voluntary benefits include:

Discount programs

- Retail and shopping

- Travel and entertainment

- Theme parks

Wellness and support

- Wellness programs: Businesses may offer their staff benefits aimed at promoting employee health and well-being, such as gym memberships, wellness challenges, and health coaching.

- Family-forming support: May include expert consultations, a knowledge base, a benefits guide, customized roadmaps, and more.

Insurance

- Accident insurance: Pays cash benefits to employees injured in a covered accident.

- Hospital indemnity insurance: Supplements existing health insurance coverage by paying cash benefits to employees if they or a covered dependent are hospitalized due to illness or injury

- Critical illness insurance: Pays cash benefits to employees or covered dependents who are diagnosed with a covered condition

- Disability insurance (short-term and long-term): Provides salary continuation for a specified amount of time if a worker cannot perform their job due to a disability. Employers may also offer this at no cost to employees.

- Supplemental life insurance: Additional coverage beyond what is provided by the employer’s standard life insurance policy

- Pet insurance: Organizations may provide discounted rates on select pet insurance policies

- Cancer support: Can offer real-time support from oncology nurses, preventive and post-diagnosis testing, and a portal to store medical records, clinical trial information, expenses, and financial aid opportunities

Financial

- Flexible spending accounts (FSA): Permits employees to use tax-free dollars to pay for certain medical and/or dependent care expenses

- Health savings accounts (HSA): Enables those with an HDHP to set aside pre-tax dollars to pay for qualified health expenses

- College savings plans: Allow employees to fund and invest tax-free in education expenses for themselves or their family members, tax-free

- Financial guidance: Connects employees with financial advisors and training sessions on budgeting, investing, and more

- Identify theft protection: Can provide employees with protective services like credit monitoring, potential fraud alerts, social media monitoring, and more

Legal and commuter

- Legal services benefits: Assist with legal topics like creating a will, family law issues, dealing with debt, and more.

- Commuter benefits: Lets employees reserve pre-tax dollars for commuting expenses (i.e., parking, mass transit fare, etc.)

See why voluntary benefits are emerging as a top recruiting tactic >>

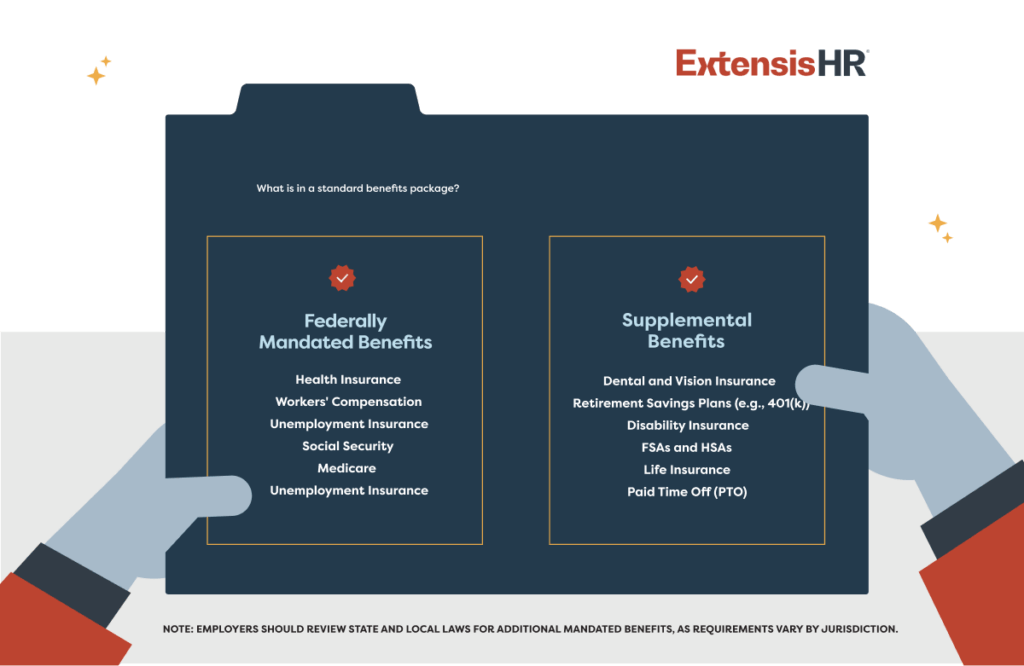

What is in a standard benefits package?

Health, dental, and vision insurance and access to a retirement savings account, are common employee benefits. However, to compete for top talent and foster employee satisfaction, many organizations have developed robust benefits packages inclusive of supplementary plans tailored to their unique workforce’s needs.

A standard benefits package may include:

Legally mandated benefits:

- Health insurance

- Workers’ compensation

- Unemployment insurance

- FMLA

- Social Security

- Medicare

Supplemental benefits:

- Dental, vision, and life insurance

- Retirement plans (e.g., 401K)

- Paid time off

- Disability insurance

- Wellness programs

- Flexible spending accounts (FSAs)

- Health savings accounts (HSAs)

How to offer employee benefits

So, how should businesses go about providing benefits to their workers? Typically, employers purchase plans from one of the following:

- A professional employer organization (PEO): A human resource outsourcing firm that provides small businesses with access to large-group employee benefit plans and various HR, payroll, and risk and compliance services.

- A broker or agent: These licensed professionals sell plans from multiple carriers.

- An insurance carrier: Plans may be purchased directly from the organizations that issue and underwrite the policies.

- The health insurance marketplace: A website operated by the federal government that allows individuals and small businesses with 1-50 employees to shop for medical plans approved by the Affordable Care Act (ACA).

Employee benefit plans vary greatly, and to create a competitive package, business leaders must determine the best package design for their workforce. They may do this by:

- Surveying staff to determine what benefits they want the most

- Estimating premium costs for the business and enrolled employees

- Confirming the providers would be used by staff

- Verifying that any applicable coverage meets ACA requirements

See guide to building a competitive employee benefits package >>

Benefits-eligible staff may choose their plans during open enrollment, a 30-60-day period that occurs once a year before the current year’s benefits renew. During open enrollment, employers should focus on communicating and educating workers on their plan options.

How much do employee benefits cost employers?

The cost of benefit plans varies depending on several factors, including the size of your organization and the level of benefits you offer. While, in general, benefits costs are rising, employers may potentially mitigate expenses through the following strategies:

- Before purchasing additional plans, conduct a benefit audit and review the details of your current policies to see if any underutilized services exist that meet your needs.

- Combine lines of insurance to potentially reduce cost (i.e., combining health and dental through the same carrier).

- Utilize voluntary wellness benefits, like an EAP, to promote employee wellness.

- Offer employee-funded premiums for some ancillary benefits.

- To stay competitive, regularly assess plan usage and eliminate underutilized plans that have become irrelevant to your employee demographic.

- Partner with a PEO that can help your small business leverage economies of scale and access better benefits at more competitive rates.

Learn more about ExtensisHR’s benefits administration services >>

Conclusion

Offering a wide range of employee benefits is fundamental to a business’s success. These plans help initially attract talent to your organization, and subsequently boost employee engagement, productivity, and retention. A tailored benefits package can improve employees’ quality of life and physical and mental wellness.

Numerous employee benefits exist. Federally-required benefits are mandated by law, ancillary benefits enhance the overall compensation package, and voluntary benefits provide additional financial protection and flexibility for employees. Together, these categories contribute to a comprehensive employee benefits package that supports the needs and well-being of employees.

Employers can purchase their benefits through a PEO partner, broker, insurance carrier, or the government-operated health insurance marketplace. Business leaders should consult with their PEO partner or an employee benefits attorney to confirm their organization complies with employment law.

Organizations should strive to offer benefits that strike a balance between reasonable cost and meeting their workforce’s unique needs and regularly re-examine their benefits package design to ensure it is effective and provides value to workers and the business.

Employee benefits FAQs

Do employers have to offer health insurance?

According to the Affordable Care Act, employers with 50 or more full-time employees or full-time equivalent employees must provide health insurance coverage to at least 95% of their full-time workers and their dependent children or incur federal penalties.

Do part-time employees get benefits?

Some laws require employers to offer certain benefits to part-time workers. State and local laws vary and may require that paid sick leave, short-term disability insurance, health insurance plans, or premiums be offered to part-time staff. Business leaders should check the laws in every state where they employ workers to confirm compliance.

How much should a company spend on employee benefits?

Many factors contribute to which benefits are suitable for a specific business, and there is no exact amount that an organization should spend on its employee benefits plans. However, according to the U.S. Bureau of Labor Statistics, as of December 2023, private industry employers’ benefits costs averaged $12.77 per hour worked per employee.

How are voluntary benefits funded?

Voluntary benefits can be funded in several ways:

- Group rates: Employers can negotiate group rates with insurance providers or other benefit vendors for voluntary benefits. By leveraging the purchasing power of the group, employers may be able to secure discounted rates for voluntary benefits, making them more affordable for employees.

- Payroll deductions: Employers can facilitate payroll deductions for voluntary benefits, allowing employees to pay for the benefits through automatic deductions from their paychecks.

- Employer contributions: Employers may choose to contribute towards the cost of voluntary benefits as part of their overall benefits package. While this is less common than employer contributions towards core benefits, like health insurance or retirement plans, it can be a strategic way to enhance the attractiveness of voluntary benefits and support overall employee well-being.

- Subsidies or incentives: Employers may offer subsidies or incentives to encourage employees to enroll in certain voluntary benefits. For example, an employer might subsidize a portion of the premium for voluntary life insurance or offer a financial incentive for employees to participate in a wellness program or health savings account.

How often should a company update its employee benefits?

It is best practice to review your employee benefits package annually to ensure compliance, analyze utilization rates, and identify new potentially valuable benefits.

How do you explain benefits to employees?

Employee benefits plans should be reviewed with all new hires and communicated each year during open enrollment. Employees should also be able to consult directly with an HR/benefits professional should they have questions arise at any point during the year, especially during qualifying life events that make them eligible to change their plans outside of the traditional open enrollment period. Employers may also ask vendor contacts to help host a benefit fair to educate employees on their available options.

When do employee benefits start?

The start date for benefits depends on your business’s needs—some organizations may offer health benefits immediately, while others may begin after a month or two. Some benefits, like Social Security and workers’ compensation, must begin on the employee’s first day.

How to design an employee benefits program?

To create an effective, impactful benefits package, employers should consider their budget, confirm plans cater to their employee population’s needs (i.e., certain health risks, looking to start a family, etc.), clearly and regularly communicate plan details to staff, and consider partnering with a PEO to maximize value.

When is open enrollment?

Open enrollment periods typically occur in the fall, while Health Insurance Marketplace® plans have an open enrollment period of November 1 through January 15. Special enrollment periods can occur year-round for those who experience a qualifying life event.

How do I confirm my employee benefits package is compliant?

Employers should consult with their PEO partner or employee benefits attorney to make sure they’re in compliance with all applicable laws.