What is a PEO? Everything You Need to Know

Looking to streamline challenging HR tasks? Consider a Professional Employer Organization (PEO), a key outsourced HR solution for startups, small businesses, and established companies alike.

This comprehensive guide breaks down everything you need to know about PEO partnerships, including benefits, costs, alternatives, and more, to help you make the right decision for your business.

What is a PEO company?

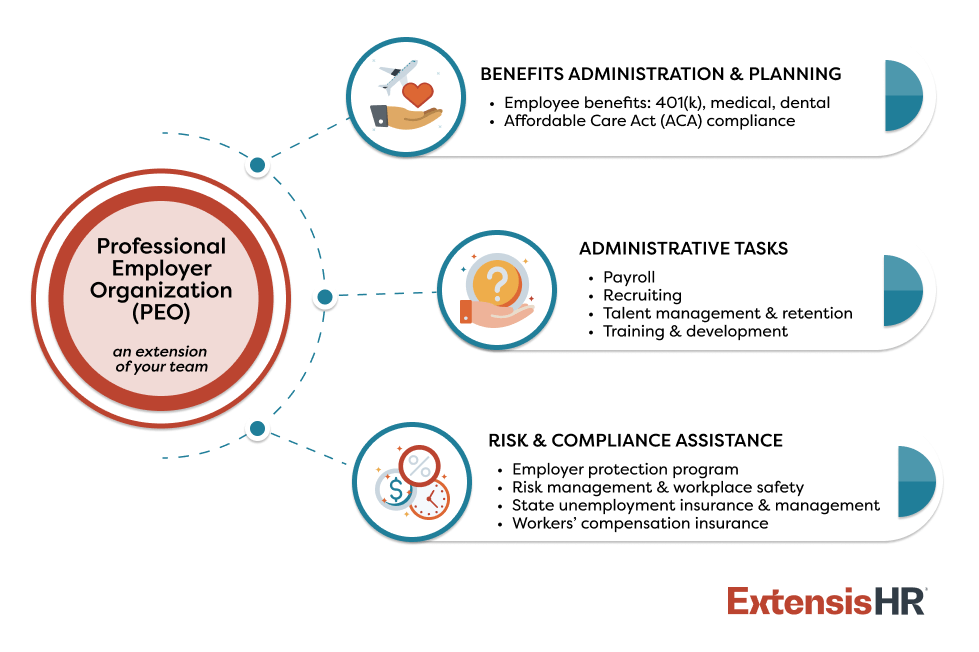

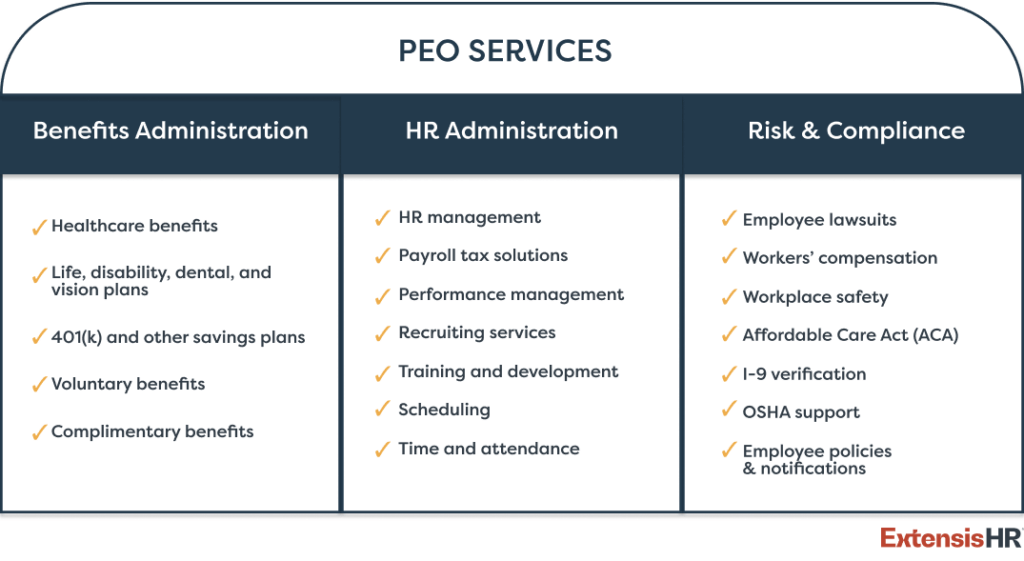

A Professional Employer Organization (PEO) is a type of human resource (HR) outsourcing service that helps businesses manage various aspects of their HR, employee benefits, payroll, risk and compliance, and other employee-related tasks.

PEO firms are a great option for small- to medium-sized businesses that need extra resources and time to compete against some of their industry’s top competitors, streamline HR processes, and alleviate administrative burdens.

PEO services can include:

Learn about our PEO solution >>

How does a PEO work?

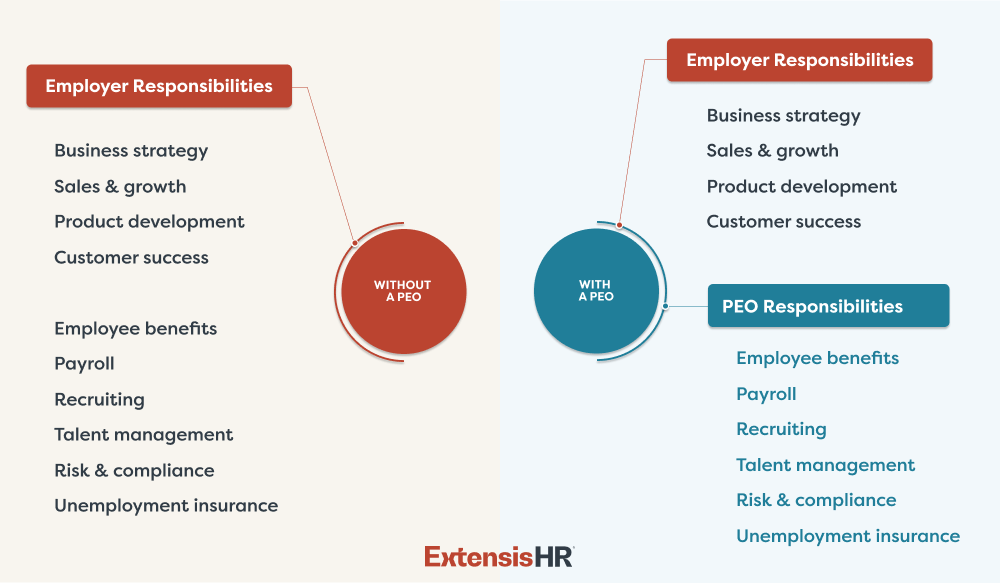

A PEO provider is a co-employer of your organization. They assume certain employer rights, responsibilities, and risk when entering into a contract with your company. While you maintain control over your business operations, who you employ, and staff advancements, a PEO manages employment-related tasks and services associated with HR.

More than just an HR outsourcing company, a PEO is a partner that becomes an extension of the team and has a vested interest in the growth of your company and the success of your employees. Hiring a PEO doesn’t mean you need to eliminate current HR staff, but it can save you from hiring more than you need in-house.

PEOs are especially beneficial to small businesses because they can handle daily employee management tasks that small business owners and small business HR teams don’t have the capacity to handle themselves. A PEO also offers competitive benefits packages to its partners’ employees, which can help small businesses compete against the larger companies in the industry for top talent.

PEO firms understand small businesses face unique challenges and help them:

- Meet compliance standards of employment laws

- Manage rising health insurance costs

- Improve recruiting and retention rates

- Create enhanced benefits, workplace perks, and culture-building opportunities

- Optimize efficiency and cost-effectiveness of HR workflows

- Consolidate vendors

- Share employee learning modules

- Utilize industry-leading HR technology

- Leverage HR guidance and support to benefit internal teams

Learn more about how a PEO works and how it benefits small businesses >>

How much does a PEO cost?

Calculate savings with a PEO >>

The cost of a PEO can vary depending on the type of PEO you choose, the number of employees you have, and the list of services you need a PEO to manage on your behalf. Typically, a PEO’s pricing structure is based on the total number of employees at your company in relation to the type of services you need.

Before you let that scare you, consider the value a PEO can add to your business. There are two returns on investment (ROIs) to consider: hard ROI costs and opportunity costs. According to the National Association of Professional Employer Organizations (NAPEO), 70% of businesses reported revenue increases after partnering with a PEO, and the hard cost savings of these partnerships averaged 27% ROI. As you evaluate working with a PEO, consider the amount you’ll pay vs. the total return on investment (ROI) you can expect to see.

Learn more about the ROI of a PEO >>

PEOs compared to other HR solutions

A PEO is not the only solution to outsourcing HR functions and services. Understanding each option can help you make a more informed decision about what your company needs to grow. Below is a detailed guide to your HR options compared to a PEO so you can determine which one is the best fit for your company.

PEO vs. HR solutions

Download the free guide: “HR Solutions – A Guide to Decoding the Difference” >>

PEO vs. employee leasing

Employee leasing is the practice of temporarily supplying new workers or contractors to a company to help them work on a specific project with a start and end date. This is a way to fill in the gaps of HR needs for a short time.

A PEO is not the same as employee leasing. When working with a PEO, you enter into a co-employment situation, which NAPEO defines as “the contractual allocation and sharing of certain employer responsibilities between the PEO and the client.” Employees are essentially employed by the client and PEO. However, the client still retains control over hiring and firing employees and making day-to-day company operating decisions. A PEO helps manage HR tasks like payroll processing, benefits, risk management, employment taxes, and other HR-related administrative tasks.

Learn more about a PEO vs. employee leasing >>

PEO vs. ASO

An administrative services organization (ASO) provides similar services as a PEO—HR administration, payroll, compliance, and benefits administration—but is not a co-employer of the business.

While this may sound ideal, one of the downsides of working with an ASO is that you retain the risk and liability of handling your employees’ benefit plans, taxes, compliance rules, etc. When working with a PEO, especially a CPEO, they bear that risk and responsibility on your behalf.

Additionally, there are some services PEOs offer (like workers’ compensation) that are not provided by ASOs. As you consider an ASO, learn more about their service offerings and how your partnership will work. Because you do not enter into a co-employment relationship with them, they do not have full permission or authority to act on your behalf, so there may be certain HR tasks they will need your authorization to do.

PEO vs. HRO

Human resource outsourcing (HRO) is a way to manage HR costs by outsourcing specific areas of your HR operations—payroll, benefits administration, risk and compliance, and HR technology—to streamline processes.

This option is commonly chosen if there are only one or two areas of HR where you could use third-party help. Selecting an HRO plan means you usually receive specific HR services versus a comprehensive solution. HRO plans are typically better for big businesses that have large internal teams to handle day-to-day HR operations and just need assistance and expertise in one or two areas.

Learn more about our HRO solution >>

PEO vs. payroll company

A payroll company specializes in, you guessed it, payroll. If you don’t need the number of services and expertise that comes with working with a PEO and only need assistance managing payroll for your company, a payroll outsourcing company may be the best option for your business. When you outsource payroll, you remove time-consuming and compliant-heavy tasks from your HR team’s workload, helping you keep your employees and HR team happy.

Significant benefits of partnering with a payroll, HRO, or PEO solution provider are the included customer support, expertise, accountability, and reporting. Simply purchasing an “easy-to-use” payroll software that an inexperienced employee runs on their downtime could become problematic.

Payroll is more than just making sure your employees get paid. It means:

- Making sure you are multistate tax compliant if you have out-of-state employees

- Keeping employees informed about latest pay stubs, increases in salary, tax and benefit deductions, etc.

- Managing workers’ compensation

- Processing payroll on a monthly basis

- Managing tax filings

Learn more about our payroll service through our PEO and HRO solution >>

What is a Certified PEO (CPEO)?

A Certified Professional Employer Organization (CPEO) is a business that has met the strictest guidelines set by the United States government to gain certification. To become a CPEO, a Professional Employer Organization (PEO) needs to meet expectations set by the Internal Revenue Service (IRS), satisfy certain bond and financial review requirements, submit background reports of employment tax payments, and undergo ongoing checks and balances by the IRS to ensure the business continues to meet its certification requirements.

Working with a CPEO vs. a PEO can provide you with peace of mind. There is less financial liability because these organizations undergo strict, ongoing reviews and are solely liable for federal employment tax payments. In other words, if taxes are not paid, the IRS will seek out the CPEO to make sure payment is made instead of holding the employer liable for the missed payment.

Learn more about a Certified PEO >>

How to choose a PEO

A PEO is more than a third-party vendor you use to manage your HR tasks and services; it is an organization you trust enough to enter into a co-employment agreement. With that in mind, here are a few recommendations to help you evaluate which PEO is right for your business, or, take this five-question survey to find your business’s perfect HR partner.

Take Survey- Consider only accredited PEOs. These are PEOs that have credentials that confirm their high level of professional conduct and can be trusted as a company partner. Accreditation can take many forms, but the two most common include accreditation through the Employer Services Assurance Corporation (ESAC) and PEOs who meet the requirements of a Certified Professional Employer Organization (CPEO).

- Avoid PEOs that outsource their services. When you work with a PEO, you want to work with its HR professionals who will be proactive about managing your account. PEOs that outsource some of these services to third parties distance themselves from your organization and your business needs.

- Ask for a dedicated HR manager. You have every right to ask for personalized attention as a potential partner. Ask the PEO you are considering if an HR manager who will be on the account can attend the initial exploratory meeting so you can get to know them, their expertise, and their processes.

- Review the company’s history. Want to really get to know a PEO? Get to know its history and previous client engagements. Learn all that you can about the company before you agree to partner with it.

- Request a tech demo. Another advantage you’ll find working with a PEO is the technology it has to offer to help manage employee benefits and training. Ask for a demo of its human resources information system (HRIS).

- Present your company’s biggest challenge. The best way you can determine if a PEO is right for your business is to see if it can help you address your biggest business challenges. They are meant to be your partner who can help you grow your business.

Learn more about ExtensisHR >>

Next steps

The right PEO will simplify HR, improve efficiency, and help you scale your business.

When you aren’t sure how to keep your business moving forward, compete against the large companies in your space, or manage top business initiatives for the year so you can continue to grow as a company, it’s time to bring in a PEO.

A PEO won’t slow you down. It will help you move faster and more efficiently so you can scale your business and finally reach the goals that have felt out of reach.

As you continue your search for a PEO, remember that PEOs should do more than just work. They make hiring easy, stay ahead of benefit trends, maintain compliance, and enable strategic growth. They are a reliable partner you can trust.

At ExtensisHR, we believe in becoming an extension of our clients’ teams. We care about what they care about, offer the best solutions to help them grow, and aim to make their lives easier.

PEO FAQs

-

What does PEO stand for?

PEO stands for Professional Employer Organization. These firms help small- and medium-sized businesses manage their human resources, employee benefits, payroll, risk and compliance, and more.

-

What doesn’t a PEO do?

A PEO is a partnership, and any good partnership should have a healthy balance of give and take.

Although a PEO can handle your daily HR tasks, it will not:

• Take over your day-to-day business operations

• Replace your HR Manager

• Communicate with your customers

• Control hiring and firing decisions

• Set pay rates or schedules

• Interfere with corporate culture

• Help with sales, marketing, or customer acquisition -

Why should I partner with a PEO?

Professional Employer Organizations provide services to almost 180,000 businesses in the United States – that’s almost four million people trusting their HR and compliance needs to these experts.

Companies that partner with a PEO:

Grow up to 9% faster: CEOs and business leaders can outsource their day-to-day HR needs to redirect internal focus to high-value activities that build a company, like strategy and employee management.

Lower employee turnover by 10% to 14%: Working with a PEO allows smaller businesses to offer their employees the same benefits as their much larger competitors. In doing so, improving company culture, employee happiness and engagement, and ultimately, reducing turnover.

Become 50% less likely to go out of business: Working with a PEO can help solve some of the challenges SMBs face. With faster growth, lower employee turnover, and reduced HR administration costs, small businesses are much more likely to succeed.

-

What’s the economic benefit of using a PEO?

Partnering with a PEO opens the door to Fortune 500-level benefits at a reasonable cost, allowing you to stay competitive in your market and offer plans that rival your largest national competitors.

PEOs pool the employees of multiple companies together, leveraging economies of scale and creating a larger group for insurance and benefits purposes. Small businesses can benefit from these cost savings and offer more comprehensive and cost-effective benefit plans to attract and retain talent.

A PEO partnership also gives you one central point of contact to eliminate the challenges and expenses of managing multiple benefits providers.

-

How does a PEO lower employment risk?

Though you can never eliminate employment risks, a PEO can be your front line of defense and help you identify, manage, and mitigate the risks that come with running a business.

-

Is a PEO the solution for my business?

There are certain qualifications a company should have to maximize the benefit of a PEO partnership, including:

Number of employees: Usually, white-collar SMBs with between 10 and 150 full-time employees are an excellent fit for a PEO.

Growth-oriented mindset: PEOs enable business owners and HR leaders to focus on growing their business instead of HR administration tasks. Small and mid-sized companies that want to grow are perfect PEO clients.

Want to provide great benefits: PEOs offer organizations access to Fortune 500-level benefits, including healthcare, vision, dental, and 401(k) plans.

Operates within specific industries: The services offered by PEOs are well suited to a range of industries, including financial services, charter schools, nonprofits, healthcare, technology, and professional services.

-

How does a PEO help me grow my business?

When you have a trusted PEO partner handling HR administration, benefits management, and regulatory requirements, you can devote more time to high-value business activities and focus on the mission of your business.

An attentive, responsive partner can:

• Make you an employer of choice for top talent

• Improve the efficiency and cost-effectiveness of your HR workflow

• Allow you to focus on your business- and revenue-generating activities

• Give you one central contact to resolve all your HR problems

• Offer better choices and better plan designs

• Provide access to world-class, personalized services from experts who know and care about your needs