HR Compliance: What Business Leaders Need to Know

Human resource (HR) compliance is critical for organizations to ensure they legally operate, protect employee rights, and mitigate risks.

By adhering to employment laws, businesses can maintain legal protection, foster a fair and ethical work environment, safeguard their reputation, avoid fines and penalties, and enhance employee trust, satisfaction, and retention.

This comprehensive guide explores HR compliance, key employment laws, and how human resource teams help create a compliant workplace. Additionally, the guide reviews common labor law compliance mistakes and best practices for managing adherence.

What is HR compliance?

HR compliance ensures an organization’s employment policies, practices, and procedures adhere to labor laws and regulations, helping businesses operate legally, ethically, and fairly.

Why is HR compliance important?

HR compliance is crucial as it ensures businesses follow all the laws, regulations, and ethical standards related to their employment and workplace practices.

Complying with legislation helps organizations stay legally protected, minimize risk, safeguard employee rights, maintain workplace safety, improve their reputation, and more.

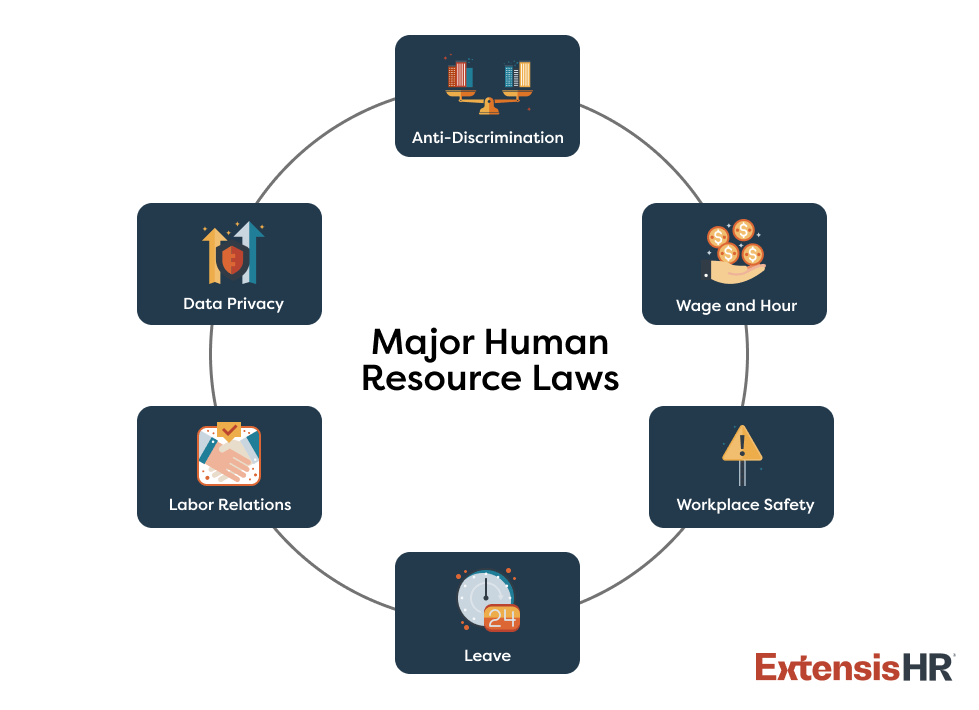

Major human resource laws

Employment laws cover many areas, including anti-discrimination, wages and hours, workplace safety, family and medical leave, labor relations, and data privacy. Below are some key HR laws to remain aware of in these categories:

Disclaimer: This is not an exhaustive list of employment laws. Please refer to your regional and industry-specific legal guidelines or consult your legal counsel for detailed and specific information.

Anti-Discrimination Laws

The Americans with Disabilities Act of 1990 (ADA): The ADA is a federal civil rights law that prohibits discrimination based on disability and assures that those with disabilities have the same opportunities as non-disabled people to pursue employment, purchase goods and services, and participate in state and local government programs.

The ADA mandates that employers with 15 or more employees provide individuals with disabilities an equal opportunity to benefit from employment opportunities available to others, including recruitment, hiring, promotions, training, pay, and social activities.

Under the ADA, an individual is considered to have a disability if they:

- experience a physical or mental impairment that substantially limits one or more major life activities,

- have a history or record of such an impairment (i.e., cancer that is in remission), or

- are perceived by others as having such an impairment (i.e., someone who has scars from a severe burn).

As a reminder, please refer to applicable state, city, and local laws, as your region may have greater benefit requirements.

To learn more about the ADA, please click here.

Title VII of the Civil Rights Act: Title VII of the Civil Rights Act prohibits employers with 15 or more employees from discriminating based on:

- Race

- Color

- Religion

- Sex (including pregnancy, childbirth, and related conditions, sexual orientation, and gender identity)

- National origin

Additionally, Title VII requires employers to provide reasonable accommodations for religious practices and makes it unlawful for employers to retaliate against someone for:

- Complaining about discrimination (formally or informally)

- Filing a charge of discrimination with an agency like the U.S. Equal Employment Opportunity Commission

- Participating as a witness in an employment discrimination investigation or lawsuit

Title VII applies to all aspects of employment, including:

- Hiring and recruiting

- Compensation

- Job assignments

- Promotions or transfers

- Usage of employer facilities

- Training opportunities

- Discipline and termination

- Retirement plans, leave, and employee benefits

To learn more about Title VII of the Civil Rights Act, please click here.

The Age Discrimination in Employment Act (ADEA): The ADEA protects certain applicants and employees 40 years of age and older from discrimination on the basis of age in hiring, promotion, discharge, compensation, or any other term or condition of employment. Additionally, it’s unlawful to harass someone because of their age.

To learn more about the ADEA, please click here.

Wage and Hour Laws

The Fair Labor Standards Act (FLSA): The FLSA determines the federal minimum wage, overtime pay, recordkeeping protocols, and youth employment standards for workers in the private sector and Federal, State, and local governments. Please note that some cities and states have separate laws concerning these topics.

To learn more about the FLSA, please click here.

The Equal Pay Act of 1963 (EPA): An amendment to the FLSA, the EPA protects individuals of all sexes from wage discrimination, regardless of gender. This Act aims to eliminate gender-based disparities in compensation and ensure all employees receive equal pay for performing jobs that require the same skill, effort, and responsibility under similar working conditions.

To learn more about the EPA, please click here.

Pay Transparency Laws: Business leaders should note that some states and cities have pay transparency laws that require employers to openly communicate job compensation with applicants and sometimes employees. Employers may need to provide wage details in written materials, such as job postings and descriptions, for both new positions and promotions.

To review cities and states with pay transparency requirements, please click here.

Workplace Safety Laws

Occupational Safety and Health Administration (OSHA) standards: OSHA establishes workplace safety and health standards that employers must follow regarding:

- General industry safety

- Construction, maritime, and agriculture safety

- Handling of hazardous materials

- Personal protective equipment (PPE) requirements

- Recordkeeping requirements

- Whistleblower protections

Please note that further workplace safety laws exist in some states and local jurisdictions.

To learn more about OSHA regulations, please click here.

Leave Laws

The Family and Medical Leave Act (FMLA): FMLA allows eligible employees of covered employers to take job-protected unpaid leave for specific family and medical reasons. All public and private-sector organizations with 50 or more employees are considered covered employers.

Note that some states and local jurisdictions have their own paid/unpaid family leave and/or paid/unpaid sick and safe leave policies.

To learn more about the FMLA, please click here.

State-Level Paid Family Leave: Several states have implemented their own Paid Family Leave programs, offering paid benefits to employees. For example, California, New York, and New Jersey provide paid family leave, allowing employees to receive a portion of their wages while taking time off for family or medical reasons. The specifics, such as duration and benefit amounts, vary by state.

To learn more about state-specific family leave policies, please click here.

Sick Leave: There is no federal requirement for private employers to provide paid sick leave. However, many states and municipalities have enacted laws mandating employers to offer it. For example, New York, New Jersey, Connecticut, and many more states require paid sick leave, with specifics on accrual rates, usage, and employer coverage varying by jurisdiction.

Please refer to your local government for details on applicable sick leave laws.

Jury Duty Leave: Federal law does not require private employers to provide paid leave for jury duty. However, employees cannot be punished for serving on a jury, and most states require employers to offer unpaid leave for employees summoned for jury duty.

Please refer to your local government for details on applicable jury duty leave laws.

Voting Leave: No federal law mandates time off for voting, but most states require employers to provide time off for employees to vote. Some states require paid time off, while others require only unpaid leave.

Please refer to your local government for details on applicable voting leave laws.

Labor Relations Laws

The National Labor Relations Act (NLRA): The NLRA protects private sector employees’ rights to openly discuss workplace concerns, seek improved working conditions, and organize a union without fear of retaliation from their employer.

To learn more about the NLRA, please click here.

The Pregnant Workers Fairness Act (PWFA): The PWFA requires covered employers to provide a reasonable accommodation to a qualified employee’s or applicant’s known limitations related to, affected by, or arising out of pregnancy, childbirth, or related medical conditions, unless doing so will cause the employer significant difficulty or expense.

To learn more about the PWFA, please click here.

The Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act: The PUMP Act expands upon the Break Time for Nursing Mothers Act of 2010, requiring employers to provide “a place, other than a bathroom, that is shielded from view and free from intrusion from coworkers and the public, which may be used by an employee to express breast milk.” Additionally, the Act mandates employers offer “reasonable break time” for employees to pump for up to one year after the birth of their child.

To learn more about the PUMP Act, please click here.

Recruiting and Hiring Laws

Background Checks: Various laws impact employers’ use of background checks. On a federal level, the Fair Credit Reporting Act (FCRA) mandates employees receive written consent from job applicants before conducting a background check. Additionally, the EEOC mandates that background checks comply with anti-discrimination laws under Title VII of the Civil Rights Act of 1964. Lastly, the “Ban the Box” law prohibits federal employers from asking about criminal history on job applications until later in the hiring process.

Some cities and states also have “Ban the Box” legislature, and restrict or ban the usage of credit checks, salary history inquiries, and arrest record reviews in employment decisions.

To learn more about FCRA employer requirements, please click here. To learn more about EEOC background check protocols, please click here. Lastly, please refer to your local government for details on applicable recruiting and hiring laws.

Required New Hire Paperwork: U.S. employers must complete various forms regarding any new hires, including:

- Form I-9: Used to verify the identity and employment authorization of individuals hired in the U.S. All U.S. employers must complete Form I-9 for each hire, and employees must also provide their employer with acceptable documents proving their identity and employment authorization within three days of their start date. To learn more about Form I-9, please click here.

- Form W-4: Determines the amount of federal income tax withholding from the employee’s wages, and must be completed by the employee before their first paycheck. To learn more about Form W-4, please click here.

- State Withholding Tax Form: Similar to the W-4, but specific to the state where the employee works (if applicable). Please refer to your local government for details on applicable state withholding tax forms.

Termination Laws

The Worker Adjustment and Retraining Notification (WARN) Act: The WARN Act requires that certain employers give at least 60 days’ written notice before conducting mass layoffs or facility closings. Employers should note that some states have enacted their own version of the WARN Act, including California, New York, New Jersey, and more.

To learn more about the WARN Act, please click here. To learn more about state-specific WARN Acts, please click here.

Final Paychecks: Final paycheck laws dictate when and how employers must provide an employee’s final wages after termination, resignation, or other separation from employment. These laws vary by state but generally specify the timing of payment, the payment of unused benefits, and payment delivery method.

Please refer to your local government for more details on applicable final paycheck laws.

Severance: Federal laws do not require employers to provide severance pay to employees. However, some states may require severance in specific situations (e.g., New Jersey’s WARN Act requires employers with 100 or more employees to provide each worker affected by the mass layoff severance pay equal to one week of pay for each full year of employment).

Please refer to your local government for more details on applicable severance laws.

Unemployment: Established by the Social Security Act of 1935, the Unemployment Insurance (UI) program is a federal-state partnership providing temporary financial assistance to employees who lose their jobs through no fault of their own. The Federal Unemployment Tax Act (FUTA) funds administrative costs for state UI programs, in which each state follows federal guidelines and sets specific eligibility criteria, benefit amounts, and durations.

To learn more about UI, please click here.

Data Privacy Laws

The General Data Protection Regulation (GDPR): GDPR is a comprehensive data privacy law enacted by the European Union (EU) designed to protect the personal data and privacy of individuals in the EU and regulate how organizations collect, process, and store this data. It applies to organizations worldwide that handle the personal data of EU residents.

To learn more about GDPR, please click here.

The Health Insurance Portability and Accountability Act (HIPAA): HIPAA is a federal law designed to protect sensitive patient health information. It establishes national standards for safeguarding medical data while ensuring patients can access and control their health records.

To learn more about HIPAA, please click here.

How do HR teams contribute to compliance?

Human resource teams are the backbone of compliance, helping manage various regulatory aspects, from recruiting and pay equity, to workplace safety and reasonable accommodations. Specifically, HR professionals:

- Help instill a culture of integrity by defining and communicating core values, educating and training employees, etc.

- Create, document, and fairly enforce company policies through consistent communication with staff, thorough investigations, and maintaining a current employee handbook.

- Stay up to date on regulations about their specific business and adjust operations and policies as needed.

- Provide avenues for employees to report unethical activity, such as anonymous tip boxes, open-door policies, compliance officers, and more.

Common HR compliance mistakes

Legal mishaps can happen to any organization, even those with the best intentions. Explore these common HR compliance mistakes and their business impact:

| Issue | Impact | |

|---|---|---|

| Misclassified workers | Misclassifying employees as exempt vs. non-exempt under the FLSA, or as independent contractors vs. employees. | Can result in violations in overtime pay, taxes, and benefits (e.g., classifying a non-exempt employee as exempt may result in unpaid overtime claims). |

| Not following wage and hour laws | Failing to track employee work hours accurately or adhere to minimum wage laws or overtime pay requirements. | Can lead to wage theft claims, costly back pay, penalties, and potential class-action lawsuits. |

| Discriminatory job listings | Job advertisements that show a preference for a candidate based on protected information or characteristics (race, color, religion, sex, gender identity, sexual orientation, pregnancy, national origin, disability, genetic information, age, etc.). Even seeking “recent college graduates” may be considered discriminatory. | Can result in fines, lawsuits, and reputational damage. |

| Inappropriate interview questions | Asking questions that violate anti-discrimination laws, including topics like age, race, color, or national origin, religion, gender, gender identity, or sexual orientation, religion, pregnancy, marital status/family, disability/health, military service, criminal record, and credit history/financial status. | Interview bias could produce discrimination claims and legal risks. |

| Incomplete or inaccurate documents | Failure to maintain updated employee documentation like I-9 forms, performance reviews, disciplinary records, or termination paperwork. | May cause noncompliance with immigration laws and penalties, and complicate legal defense. |

| Outdated handbooks and policies | Relying on outdated or generic employee handbooks that don’t reflect current labor laws, regulations, or company policies. | Employees may be misinformed, leading to noncompliance with new laws or internal standards, potentially exposing the business to legal claims. |

| Improperly handling employee leave | Mismanagement of employee leave (e.g., FMLA leave, sick leave, etc.), including inaccurately tracking or denying eligible leave. | Can result in employee dissatisfaction, legal violations, and penalties for not adhering to mandated leave laws. |

| Inconsistent termination practices | Inconsistent or improperly documented termination practices, such as failure to follow due process in performance management, or not providing final paychecks promptly. | May bring about wrongful termination lawsuits, wage claims, or discrimination accusations. |

| Failure to train employees on compliance | A lack of training on compliance-related topics, like workplace safety, harassment prevention, and diversity and inclusion. | Lack of employee awareness of legal obligations can cause inadvertent violations, unsafe work environments, or harassment issues. |

| Noncompliance with ADA | Not providing reasonable accommodations for employees with disabilities. | Can cause lawsuits, fines, and damage to company reputation. |

| Noncompliance with OSHA | Failure to provide a safe workplace or not following OSHA regulations. | Workplace accidents, injuries, or illnesses may result in penalties, higher workers’ compensation costs, and liability. |

| Improperly handling confidential employee information | Mishandling or improperly securing employee records, especially sensitive information like health data, social security numbers, and personal contact details. | Data breaches, legal actions, fines, and reputational damage may occur. |

| Incorrectly running background checks | Failing to properly conduct background checks, such as not getting authorization or using information to discriminate. | Potentially violates the Fair Credit Reporting Act (FCRA) and other background screening laws and may lead to lawsuits. |

| Noncompliance with benefits laws | Not offering required benefits, such as health insurance under the ACA, or mismanaging COBRA benefits for departed employees. | Could result in penalties, lawsuits, or fines from government agencies. |

| Irregular auditing | Not conducting regular internal audits or compliance checks of HR policies, processes, and records. | Small issues may compound into significant legal risks and financial liabilities. |

| Inaccurate payroll/tax payments | Incorrectly calculating and filing payroll taxes to the relevant government agencies. | Potential audits and fines may occur. |

| Unfair pay practices | Failure to adhere to the EPA or state-specific gender pay inequality laws; may occur inadvertently during transfers, promotions, etc. | Can lead to fines, lawsuits, and reputational damage. |

| Multistate mishaps | Unawareness of the impact a dispersed workforce has on the organization’s state employment law liabilities, taxes, payroll, compliance, recruiting, and employee benefits. | Fines and lawsuits are possible. |

How to manage HR compliance

Managing HR compliance is a complex endeavor that involves staying up to date on applicable employment laws and regulations and ensuring your organization adheres to them. As you plan how to keep your business compliant, consider the following best practices:

- Develop comprehensive policies: Become familiar with the employment laws that impact your organization and develop policies accordingly.

- Educate staff: Communicate policies with staff by maintaining an updated employee handbook and conducting training sessions as needed.

- Subscribe to official updates: Awareness is key, and receiving timely news from the Department of Labor, the Equal Employment Opportunity Commission, and other government agencies can keep you informed about emerging legislation.

- Prioritize recordkeeping: Develop thorough processes for personnel files, payroll records, and compliance documentation.

- Regularly audit compliance practices: Periodically review HR practices and promptly flag and mitigate any weaknesses.

- Stay a step ahead: Anticipate future law changes by monitoring industry publications, such as Fisher Phillips, the Society of Human Resource Management (SHRM), and more.

- Consult a legal professional: Refer to an employment attorney on issues impacting your specific organization, industry, and locations of business.

- Network with other HR leaders: Collaborate to discover what HR compliance tactics are proving successful for your peers.

- Outsource to a professional employer organization (PEO): Due to the complicated nature of HR compliance, many small- and medium-sized businesses choose to outsource the practice to a PEO.

A PEO is a type of HR outsourcing provider that helps companies manage various aspects of their human resources, employee benefits, payroll, risk and compliance, and other employee-related tasks. In a co-employment relationship, a PEO assumes certain employer rights, responsibilities, risk, and other HR administrative tasks. These can include:

- Remitting wages and withholdings of the clients’ workers

- Issuing Form W-2 for compensation under its Employer Identification Number

- Reporting, collecting, and depositing employment taxes with local, state, and federal authorities

Meanwhile, the client retains control over hiring and firing and continues to make day-to-day operating decisions.

FAQs

What is HR compliance?

HR compliance is the process of ensuring that a company’s human resources policies, practices, and procedures adhere to local, state, and federal laws and regulations. It involves creating and maintaining processes to confirm that the organization legally operates while promoting a fair, safe, and ethical workplace.

What are the five major kinds of employment laws?

The five major kinds of employment laws include:

- Anti-discrimination laws: Some common anti-discrimination laws include the Americans with Disabilities Act of 1990 (ADA), Title VII of the Civil Rights Act, and the Age Discrimination in Employment Act (ADEA).

- Wage and hour laws: Including but not limited to the Fair Labor Standards Act (FLSA), the Equal Pay Act of 1963 (EPA), and state- and city-specific pay transparency regulations.

- Workplace safety and health laws: Such as the standards outlined by the Occupational Safety and Health Administration (OSHA).

- Family and medical leave laws: Like the federal Family and Medical Leave Act (FMLA), which applies to employers with 50 or more employees.

- Employment and labor relations laws: Including but not limited the National Labor Relations Act (NLRA), the Worker Adjustment and Retraining Notification (WARN) Act, the Pregnant Workers Fairness Act (PWFA), the Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act, and more.

Disclaimer: This is not an exhaustive list of employment laws. Please refer to your regional and industry-specific legal guidelines or consult your legal counsel for detailed and specific information.

What is the best way to achieve compliance in HR?

Business leaders who are considering how to achieve compliance in HR should consider the following best practices:

- Develop, record, and educate staff on comprehensive policies.

- Subscribe to updates from the Department of Labor, the Equal Employment Opportunity Commission, etc.

- Practice thorough recordkeeping for personnel files, payroll records, and compliance documentation.

- Regularly audit compliance practices and identify any potential concerns.

- Stay current on legislative updates by monitoring industry publications, such as Fisher Phillips, the Society of Human Resource Management (SHRM), etc.

- Consult an employment attorney on issues impacting your specific organization, industry, and locations of business.

- Connect with other HR leaders to learn how they manage their organization’s HR compliance.

- Consider partnering with a professional employer organization (PEO) whose experts can help you manage HR risk management, access competitive employee benefits, and more.

What are the consequences of noncompliance with HR laws and regulations?

Noncompliance with HR laws and regulations can lead to significant consequences for organizations, including:

- Lawsuits

- Fines or settlements

- Reputational damage

- Increased premiums for employment practices liability insurance (EPLI)

- Possible criminal charges

- Reduced employee morale and increased turnover

- Operational disruption