5 Common Open Enrollment Mistakes to Avoid

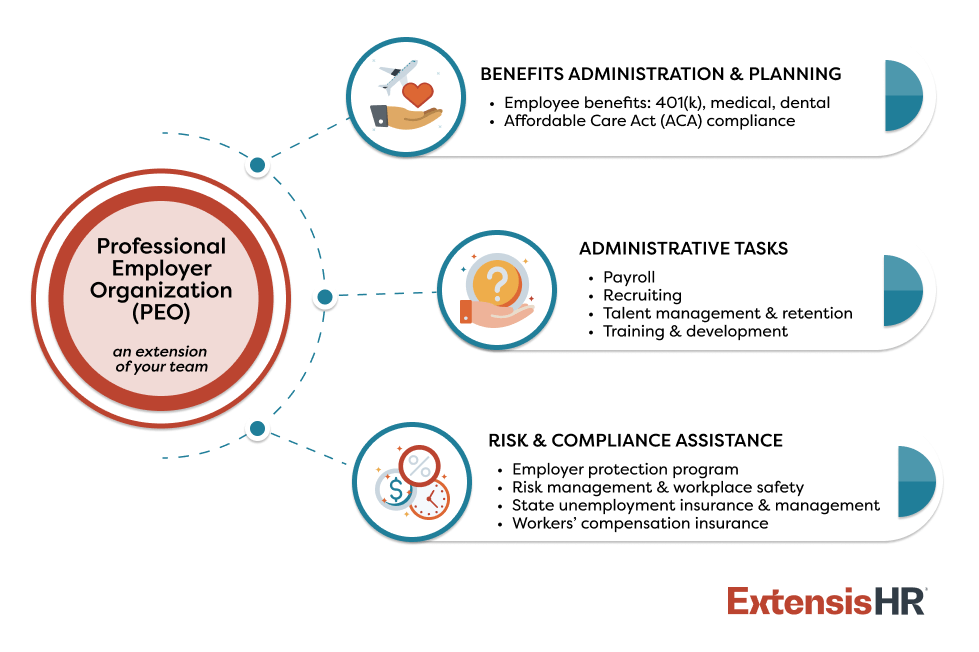

Quick look: Every season matters in business, but the fall months hold special significance as open enrollment unfolds. The way employers design and communicate their benefits packages greatly impacts their ability to attract and retain top talent. However, missteps are common and can be costly. Here are five frequent pitfalls to avoid during this time and how a professional employer organization (PEO) can simplify the process.

Providing your workforce with affordable, tailored benefits is no longer optional, it’s essential for staying competitive. Mercer’s Survey on Health and Benefit Strategies for 2026 shows that approximately half of employers now include broader aspects of well-being in their benefits plans. Further, 70% of employees say they’d switch jobs for better benefits.

Open enrollment is an opportunity to remind staff of the value of your organization’s benefits offerings and spark an increase in retention, but it must be approached thoughtfully to make the biggest impact.

As we enter open enrollment season, here are five common mistakes to avoid and how working with a professional employer organization (PEO) can streamline and enhance the process.

All the open enrollment tools you need, in one guide.

Access free expert-backed tips, plus several customizable, ready-to-use templates.

Get My Copy

Mistake #1: Communicating too little or too late

Small business leaders have a lot on their plates and it’s easy for open enrollment announcements to slip through the cracks and come close to the deadline.

Additionally, many people underestimate the full value of their benefits package. For example, an employee may not realize that their employer is covering a large portion of their healthcare premiums or offering a generous retirement match. Without visibility into these investments, staff may undervalue their total compensation, which can lead to disengagement or turnover.

It’s also crucial to note that under the Affordable Care Act (ACA), applicable large employers (ALEs) are required to communicate with employees about their health insurance coverage options, regardless of whether they offer benefits.

And while open enrollment is an important time to discuss plan options with employees, sharing ongoing education and resources throughout the year can increase health literacy.

How a PEO helps: By giving employees a clear view of their total benefits, a PEO helps them fully appreciate their employer’s investment in their well-being. PEOs can craft personalized, easy-to-understand communications before, during, and after open enrollment, helping staff feel informed, valued, and confident in their benefits choices.

Mistake #2: Missing deadlines

For most companies, open enrollment lasts for a limited window and timely communication is key to ensuring everyone enrolls by the deadline. If not, they and their family may lose coverage, and the business could face a fine under the Affordable Care Act (ACA).

How a PEO helps: Even with continuous communication, some staff may miss the open enrollment deadline. A PEO partner helps avoid this situation by sending proactive, ongoing reminders. If an employee forgets to enroll, your PEO’s HR Business Partner should be available to discuss options and elections for the following year.

Mistake #3: Defaulting to last year’s plan

The modern workforce is diverse and what works for one employee may not fit another. For example, a young professional may value student loan repayment support, while a working parent may prioritize more comprehensive family healthcare coverage. Employers that provide limited options without considering employee needs risk lower satisfaction and may struggle to recruit and retain top talent.

Defaulting to last year’s plans can also hold employees back from choosing what best supports their success. People tend to stick with what they know, even if a change could be advantageous. Encourage employees to review their yearly medical expenses and plan usage, as well as any upcoming life changes like having a new baby or undergoing surgery. Open enrollment is an ideal time to evaluate whether to add additional coverage or waive certain plans if necessary.

How a PEO helps: Through their group purchasing power, PEOs provide access to a wide range of benefits typically reserved for larger organizations. This includes medical, dental, and vision coverage, as well as voluntary benefits like pet insurance, legal services, family-forming support, etc. Additionally, ExtensisHR’s Employee Solution Center helps your staff compare plans, discuss qualifying life events, and more to ensure your staff choose the benefits that best meet their needs.

Mistake #4: Overlooking compliance requirements

Open enrollment isn’t just about selecting benefits; it also involves multiple compliance requirements. From ACA reporting and COBRA notices to HIPAA privacy rules and state-specific mandates, it’s easy for obligations to fall off the radar. However, noncompliance can result in penalties, fines, or even lawsuits.

How a PEO helps: PEOs stay up to date on federal, state, and local regulations, ensuring small and midsized businesses (SMBs) remain compliant. They manage essential tasks like generating ACA reports, issuing COBRA notices, and aligning benefit offerings with legal requirements. With a PEO, employers can focus on supporting their teams, knowing compliance is under control.

Mistake #5: Underutilizing technology

More people than ever work remotely or on a hybrid schedule. To accommodate this new dynamic, it’s important to make open enrollment messages and meetings accessible for all employees through multiple channels. This could include virtual seminars, sending monthly newsletters via email, and hosting all information on an online portal where people can view their current plans and explore new options.

This is especially important as younger people enter the workforce. Gen Z employees are technology savvy, having never grown up in a world without social media or the Internet. Similarly, millennials, who currently comprise the largest share of the U.S. workforce, tend to prefer receiving information virtually.

How a PEO helps: Many PEOs invest in modern human resources (HR) technology so their customers don’t have to. ExtensisHR, for example, helps streamline the open enrollment process with its Work Anywhere® platform and mobile app, allowing staff to review and enroll in their benefits right from their phones or tablets. This efficiency reduces errors, saves time, and elevates the overall employee experience.

ExtensisHR: Strengthening SMBs’ benefits strategies, all year long

In today’s competitive labor market, open enrollment is about more than just checking a box; it’s an opportunity to demonstrate your investment in your people and increase retention.

Partnering with a PEO like ExtensisHR empowers SMBs to:

- Deliver clear, timely, and effective communication

- Stay compliant with ever-changing laws and regulations

- Provide competitive, personalized benefits packages

- Highlight the full value of employee compensation

- Simplify the enrollment process with technology

- Expertly and quickly answer employees’ questions

Open enrollment offers the chance to engage and support your workforce, and ExtensisHR is ready to help you turn this traditionally stressful season (and beyond) into a catalyst for success.

Let’s make this year’s open enrollment the best one yet. Learn more about ExtensisHR’s employee benefits solutions, or contact us to start a conversation today.