Is an HSA the New 401(k) When It Comes to Retirement ROI?

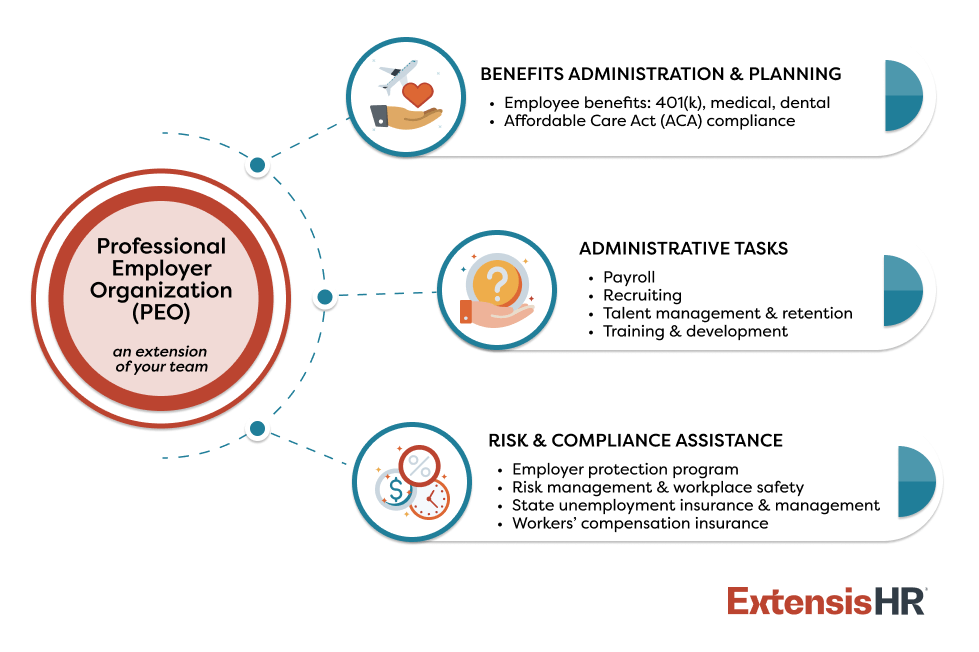

Quick Look: Flexibility and cost savings are two of the biggest priorities when it comes to workplace benefits. However, between HSAs, FSAs, and 401(k)s, it can be overwhelming to understand the value of each. Working with a PEO partner is beneficial for both employers and their employees to ensure everyone is well-informed and set up for future financial success.

Costly medical expenses and confusion about benefits language are leaving employees feeling discouraged about their healthcare and retirement options. Often, health savings accounts (HSAs) get grouped in with flexible spending accounts (FSAs) and leave people in the dark about what each actually offers.

An HSA presents significant cost-saving benefits for both employers and employees. It’s a flexible savings account specifically set up by an individual to pay pre-taxed medical expenses. Employers save 7.65% on federal payroll taxes on employees who contribute pre-tax payroll deductions to their HSAs. Concurrently, employees can use the money saved in their HSA for qualified healthcare expenses when in retirement. Alternatively, an FSA is a designated account owned by an employer to save money to be used for out-of-pocket healthcare costs without being taxed.

So, does this really make an HSA the new 401(k)?

Yes and no. Though an HSA shouldn’t be defined as an official retirement plan like a 401(k), it can be part of a comprehensive retirement strategy. Many people plan for Medicare to cover their healthcare spending in retirement, when in reality, the program covers only a portion of a person’s retirement healthcare expenses.

Coupled with the fact the average balance of retirement savings accounts is approximately $100K, which is disproportionate to the current life expectancy beyond retirement age, it makes retired life more expensive than it once was. Therefore, it’s helpful for small- and medium-sized (SMB) employers to encourage HSAs as a way to prioritize employee health and financial well-being.

Why the rise in HSAs?

Since the creation of HSAs in 2003, there has been rapid growth driven by employees wanting to cover rising healthcare costs in retirement. In 2021, Fidelity reported a 50% increase of HSA assets over a year. Data has also shown approximately 30% of retirement account withdrawals are used for healthcare expenses.

Meanwhile, the recent workforce transformation has introduced new trends driving HSA interest. More employers have also moved to high-deductible health plans (HDHPs) with an HSA. And employees are investing in their financial wellness now more than ever as they prepare for their future. These shifts combined with a historically competitive workforce make it even more beneficial for SMB employers to work with a PEO partner when determining how best to invest in and subsequently, retain valuable employees. Here are ways they can get started:

1. Provide ongoing education

Many companies limit delivering healthcare information to annual open enrollment periods, which doesn’t always leave enough time to make a well-informed decision. Alternatively, by offering continuous education through online portals, frequent webinars, and other in-person or digital resources, employees can focus on what they need for their present situation and decide what steps would put them in the best health and financial position.

After all, employees can’t benefit from what they don’t know. Many don’t realize not everyone is eligible for an HSA. Employees must first be enrolled in an HDHP to take advantage of HSA benefits. However, a 2020 JAMA Network survey reveals 1 in 3 adults with an HDHP have not set up an HSA, and those who have did not contribute money to it in the past year.

Furthermore, it’s important to track maximum contribution amounts, which can vary from year to year. In 2022, employees part of an HDHP can contribute up to $3,650 for self-only coverage and up to $7,300 for family coverage into an HSA. When HSA funds aren’t spent, they roll over to the following year. Additionally, an HSA may earn interest which allows employees to increase their retirement savings with the flexibility to access it for medical expenses without being taxed.

2. Maximize HSA incentives

Offering matching contributions can encourage enrollment in an HDHP with an HSA. Job candidates are being more selective with their employment options and seek out companies which align with their lifestyle needs. Research shows 43% of employees who resigned in 2021 cited “not having good benefits” as a reason for leaving. Maximizing incentives deliver a competitive advantage for SMB employers while also saving them money.

3. Prioritize work-life balance with FSAs

Also, since the start of the pandemic, there’s been a greater emphasis on achieving a healthy work-life balance. 48% of participants in the Great Resignation mentioned childcare issues as a main reason for voluntarily leaving their roles. One opportunity a PEO partner can help SMB leaders explore is a Dependent Care Flexible Spending Account (DC-FSA), which covers daycare expenses for qualified family members and is an attractive benefit for today’s job candidates.

Plan a better financial future with a PEO partner

People are redefining how they save for retirement and what they value most when it comes to compensation packages. Now is an opportunity for SMB leaders to reevaluate their benefit offerings and incentive programs to improve employee engagement and attract top job candidates.

ExtensisHR implements and manages well-designed health benefits plans tailored to SMB needs and objectives with a focus on the financial wellness of employees and the business itself. With the right plan structure and a dedicated HR team in place, it can increase employees’ retirement readiness and prolong their job satisfaction while saving employers money at the same time.

The workforce is in the midst of a major transition and staying up-to-date is essential in order to stay competitive. Contact the experts at ExtensisHR to handle all things HR while you spend time growing your business.