What is Co-Employment? A Complete Guide for SMBs

Quick look: Hundreds of thousands of small- and medium-sized businesses are involved in a co-employment relationship, or the contractual sharing of employer responsibilities between a company and a professional employer organization (PEO). Why? Co-employment helps businesses save time, mitigate risk, access high-quality employee benefits, and more. Read on to explore the ins and outs of co-employment and how to know if it makes sense for your organization.

Running a small business involves juggling many responsibilities, from managing employees to ensuring compliance with ever-changing labor laws. For many company leaders, these tasks can feel overwhelming—and that’s where co-employment comes in.

Co-employment is a partnership model allowing businesses to share certain responsibilities with a professional employer organization (PEO). This arrangement streamlines human resources (HR) functions, minimizes compliance risks, and allows businesses to focus on their core operations.

In this blog, we’ll break down the details about this partnership, including business advantages, each party’s responsibilities, and how to determine if co-employment is a fit for your organization.

What is co-employment?

According to the National Association of Professional Employer Organizations (NAPEO), co-employment is “the contractual allocation and sharing of certain employer responsibilities between the PEO and the client.”

When a small business partners with a PEO, its staff becomes employed by two entities: the client company, which is called the worksite employer, and the PEO, which is called the administrative employer.

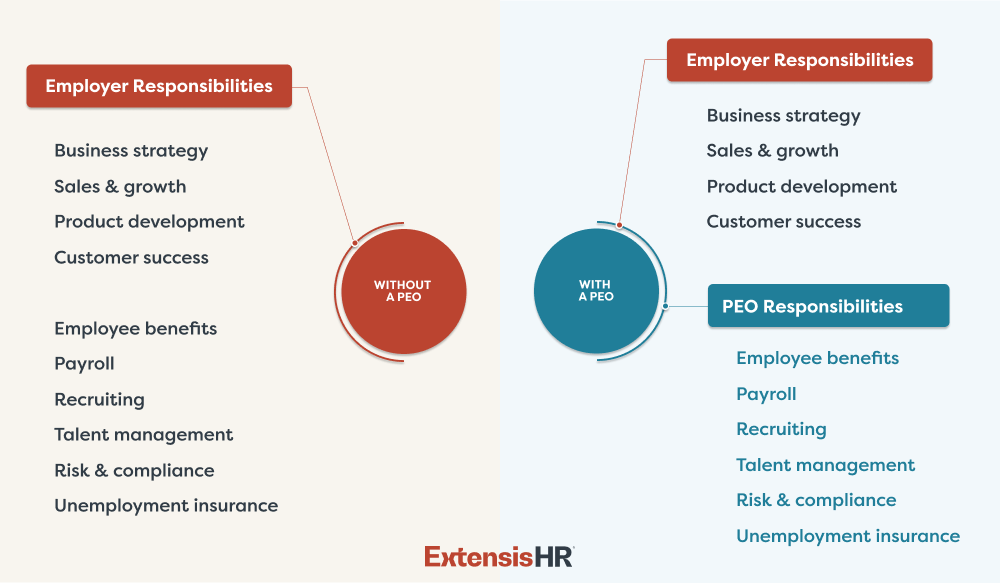

As the administrative employer, the PEO contractually assumes specific responsibilities. Meanwhile, the customer maintains control and direction over their employees and all daily operations.

Who does what in a co-employment arrangement?

As a business owner, you retain total control over recruitment, terminations, promotions, and organizational workforce changes in a co-employment partnership. You must simply notify your PEO of new hires, pay changes, and promotions so that HR administrative and compliance reporting is up to date. If desired, your PEO may provide recruiting assistance to help you identify and secure top talent.

The employment-related services PEOs provide include:

- Payroll processing and tax administration

- Comprehensive employee benefits and management

- HR support and guidance

- Workers’ compensation coverage and claims management

- Risk and compliance assistance

- Access to HR technology platforms

In short, PEOs focus on employment-related issues, while business leaders continue to oversee daily operations, business growth, employee supervision and evaluation, job assignments, sales, marketing, and workers’ salaries and benefits.

Co-employment vs. employee leasing

Co-employment is often confused with employee leasing, but they are entirely different dynamics.

Employee leasing involves a business renting or hiring workers from a staffing firm or leasing agency. In this setup, the leasing agency acts as the employer of record, handling tasks like payroll, taxes, and benefits administration, while the client company oversees employees’ daily work.

Unlike co-employment, employee leasing transfers much more control and responsibility to the staffing agency. This can make it a less flexible and collaborative solution than co-employment, and business leaders must understand the differences and use cases for each.

Advantages of co-employment

A co-employment model allows business leaders to offload their routine HR tasks and focus on higher-value projects—but the benefits extend well beyond that.

NAPEO reports that, compared to similar organizations without a PEO partner, PEO customers:

- Experience a 2% higher growth rate

- Have a 12% lower employee turnover rate

- Are 50% less likely to go out of business

Additionally, according to NAPEO, the return on investment of using a PEO is 27.3% in cost savings alone. Co-employment is shown to boost employee satisfaction levels, with research demonstrating that those who work for a business in a PEO arrangement:

- Are more engaged

- Believe their employer is taking the right steps to remain competitive

- Are more likely to stay with their employer until retirement

- Feel confident in their employer’s approach to growing the company

Is co-employment right for your business?

Under the right circumstances, co-employment can help you save time and resources, hire and retain top talent, mitigate risk, and access high-quality employee benefits and technology. But how do you know if it’s the right option for your company?

A PEO partnership is typically ideal for small- and medium-sized businesses with between 10 and 250 employees. White-collar industries tend to be the best fit, including:

- Business and professional services

- Consumer goods companies

- Financial services and financial technology firms

- Marketing agencies

- Healthcare providers

- Life sciences businesses

- Media organizations

- Technology companies

- And more

Still wondering if PEO makes sense for you? Take our free assessment now >

How to choose a co-employment partner

If you’ve decided that a co-employment arrangement could be beneficial, the next step is evaluating potential PEO partners.

While most PEOs offer similar services like access to health insurance and retirement plans, their credibility and customer service levels vary greatly, as does their ability to personalize solutions.

It’s helpful to keep these criteria in mind when assessing potential partners:

- Breadth of services: Does the PEO allow you to customize your benefits package, and do they offer a variety of plans that fit the needs of today’s diverse workforce?

- Certifications: Do they hold key industry accreditations, including:

- IRS-Certified PEO (CPEO): Verifies that a PEO routinely passes strict audits and is certified by the IRS.

- Employer Services Assurance Corporation (ESAC): Confirms “a PEO’s ongoing financial stability, ethical business conduct and compliance, and adherence to operational standards, government regulations, and important industry standards.”

- SOC 1 Type 2 Certification: Demonstrates that a PEO has established and maintained effective internal controls over financial reporting and data security.

- Service level: Will you receive access to dedicated account management? What is the service level agreement for employee-level requests, such as portal login issues or payroll questions?

- Customer satisfaction: How happy are the PEO’s current customers? What is their customer retention rate?

ExtensisHR: where expertise meets attentiveness

Hundreds of PEOs exist in the U.S., and searching for the right one can feel daunting. If you’re seeking a PEO that offers enterprise-level services with a boutique touch, ExtensisHR could be the right choice.

We proudly provide a comprehensive range of HR solutions, including recruiting services, at no extra cost. Additionally, our customer support sets us apart, with designated HR and Payroll Specialists and an Employee Solution Center that answers your workers’ phone calls in under 15 seconds. And with integrity as a priority, we maintain adherence to IRS CPEO, ESAC, and SOC 1 Type 2.

Looking to learn more about co-employment? Download the free eBook, “How Well Do You Know PEO?,” or explore why ExtensisHR stands out from big-box PEOs.